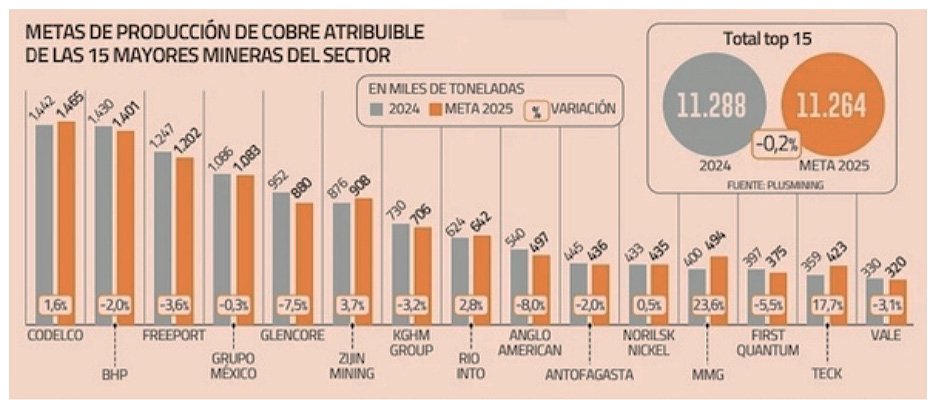

Estimates gathered by Plusmining show that the group of the world’s leading copper producers would close the year with a decline in attributable production.

By Patricia Marchetti

“In 2025, the world will need 3% more copper, but the world will not produce even 1 ton more.” This is how Codelco’s board chairman, Máximo Pacheco, illustrated the state of the global copper market—one that Chile has historically led, but whose position must now be secured amid trade tensions, geopolitical issues, and a series of industry-specific challenges.

Just as demand for the red metal is expanding due to the energy transition and electrification, the global copper industry is facing a loss of momentum—or “stagnation,” as Pacheco stated during the Ministry of Mining’s annual public report. He emphasized: “Codelco’s biggest challenge is to increase copper production.”

The scenario described by Pacheco—and long anticipated by the market—is reflected in data compiled by Plusmining and accessed by Diario Financiero. These figures compare the performance of the 15 largest copper producers in 2024 versus their attributable production targets for 2025 (based on each company’s equity stake in its operations).

“At a global level, according to our analysis based on company reports, the expected performance shows a fragile balance between expansions and declines in attributable production,” says Juan Cristóbal Ciudad, Senior Analyst of Market and Industry, in this report.

Of the 15 major copper producers, nine are forecasting a year-over-year reduction in 2025, which together would subtract around 257,000 t of fine copper from the market. On the other side, only six companies are expected to post increases, contributing approximately 233,000 tonnes in 2025. Bottom line: “The increase would not be enough to fully offset the expected declines, reflecting a scenario where supply remains under pressure,” the mining expert explains.

The largest decline in tonnes would come from Glencore (-72,000 t), due to adjustments in its South American mining plans, including lower recovery from low-grade stockpiles and water restrictions at Collahuasi (where it holds a 44% stake), lower ore grades at Antamina (Peru), and sequencing challenges at Lomas Bayas (Chile).

U.S.-based Freeport projects a 45,000 t drop due to lower grades at Cerro Verde and in Indonesia, as well as at most of its Chilean mines. However, the current scenario in the United States—amid tariffs on red metal imports—could drive up domestic production and offset these projections.

Meanwhile, South Africa’s Anglo American forecasts a 43,000 t drop due to lower processing rates at Los Bronces, which could be balanced by growth at its Peruvian asset, Quellaveco.

The largest production gains are expected from MMG, due to its operations in Las Bambas (Peru), Kinsevere (Congo), and Khoemacau (Botswana), and from Teck through its expansions at Highland Valley in Canada and Quebrada Blanca in Chile.

It is worth noting that these estimates for 2025 could be updated with the second quarter results.

Chile and Codelco

In this context, Ciudad from Plusmining highlights that “Chile is once again at the center of attention. While it is leaving behind the historically low levels of 2022 and 2023 (which bottomed at 5.2 million tonnes of total production), it would see moderate overall growth in 2025.” Still, the mining giant of the Southern Cone will represent a quarter of global copper production.

Zooming in on the operations in the world’s driest desert, the growth is expected to be driven, among other companies, by Codelco and Quebrada Blanca—which is 60% owned by Teck, 30% by Sumitomo, and 10% by Codelco. This will be partially offset by declines at Los Bronces (50.1% owned by Anglo American, 29.5% by Codelco and Mitsui, and 20.4% by Mitsubishi) and at Collahuasi (44% owned by Anglo American, 44% by Glencore, and 12% by Japan Collahuasi Resources), due to operational challenges.

The analyst highlights Codelco’s recovery in 2024 but warns that as a symbol of the global market, it faces several challenges that could impact its capacity, such as the structural fatigue of its most iconic mines.

“The concern is not limited to Codelco: projections for 2027 show a drop back to levels similar to those of 2023,” he says, stressing the importance of accelerating investment, unlocking projects, and strengthening the sector’s operational resilience.

Source: Diario Financiero