By Andrés González

The death of six workers on July 31 at the Andesita project, part of Codelco’s El Teniente Division, caused shock across the global mining community. First, the fact that an accident resulted in the loss of six lives is highly unusual, not only for Codelco but also for Chilean mining in general. Second, there is the question of how quickly production can be safely resumed. Finally, and linked to the above, it is crucial to assess the magnitude of the impact this event will have on Codelco’s copper production and, by extension, on the country’s copper supply.

As context, El Teniente’s production has been on a downward trend, decreasing from 475 ktCu in 2016 to 356 ktCu in 2024. Even before the accident, Codelco’s forecasts estimated production at 336 ktCu in 2025 and 321 ktCu in 2026, representing a drop of around 150 ktCu compared to a decade ago.

This decline is mainly due to the depletion of reserves in currently mined areas, which has driven the division to develop operations at greater depths in order to sustain production and extend its life by 50 years.

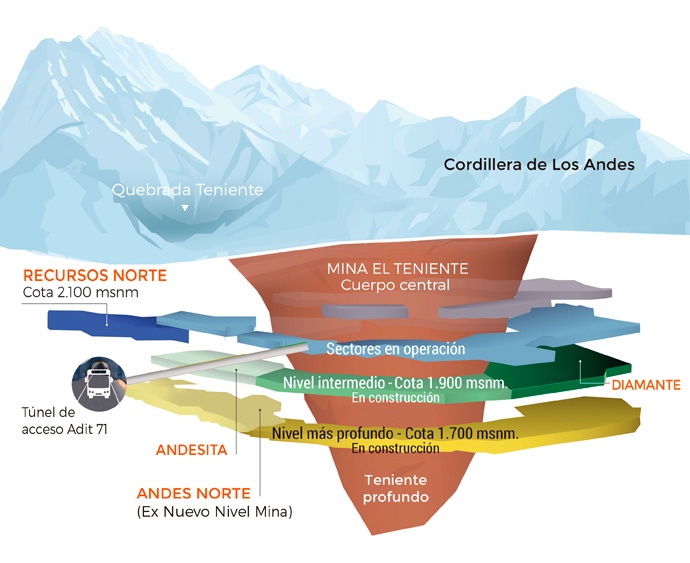

To this end, three projects are underway: Andesita, 70% complete as of March 31, 2025, with a planned start in the second quarter; Andes Norte, 78% complete and scheduled to start in the third quarter; and Diamante, 43% complete, expected to begin in 2026.

Together, these projects would add approximately 260 ktCu/year, although their combined contribution in 2025 was estimated at only about 10 ktCu. Additionally, Recursos Norte, in operation since 2020 with a steady-state output of 60–70 ktCu/year, was also affected by the accident, despite not being part of the new developments plan. The figure below shows these four areas in relation to the existing underground sectors in operation.

Figure: Map of Andesita, Andes Norte, Diamante, and Recursos Norte. Source: Codelco.

Nine days after the incident, Sernageomin and the Labor Directorate authorized the resumption of operations in Rajo Sur and the older underground sectors, but maintained restrictions on the four new areas mentioned above.

Given this, the greatest production impact comes from Recursos Norte, and to a lesser extent from Andesita and Andes Norte. According to estimates from the Ministry of Mining, the shutdown would mean an 18% drop in production for the remaining five months of 2025, equivalent to about 27.5 ktCu less than the total in 2024.

This figure roughly matches the projection of halting production at Recursos Norte for the rest of the year. If Andes Norte and Andesita are also excluded from 2025 production, the decline could slightly exceed 30 ktCu.

Although a reduction of around 30 ktCu is not critical for Codelco — which produced about 1.5 Mt in 2025 — or for Chile — which produces 5.5 Mt annually — it does pose significant risks for El Teniente’s overall development plan. Indeed, if the delay extends for several months, it could jeopardize Codelco’s already ambitious goal of exceeding 1.7 Mt by 2030. Likewise, it could worsen its medium- and long-term financial situation, given its steadily rising net financial debt, currently above US$23 billion.

In summary, while the effects on the state-owned company’s production and finances may be relatively contained in 2025, the impact in subsequent years could increase, depending on the severity of the problem and its resolution, as well as on the prospects for resuming operations with appropriate safety guarantees for workers.

Source: Guía Minera de Chile